Why Do You Need To File K1 Tax Form The need for K1 tax form is due to the concept of pass-through taxation. Open (continue) your return if you don't already have it open.Search for 1095-A and select the Jump to link at the top of the search results.

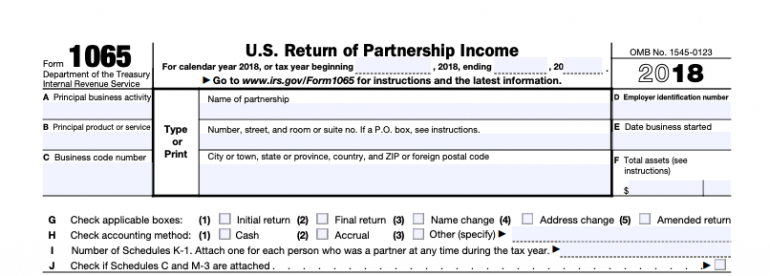

Once you have determined and finalized the tax return, we will update the tax documents and send you a copy of. Answer Yes on the Did you receive Form 1095-A for your health insurance plan? screen and Continue.#WHY WOULD YOU RECEIVE A 1065 TAX FORM UPDATE# Enter your 1095-A info on the next screen and select Continue.We don't need all the info from your 1095-A, so we'll only ask about the info that affects your return. If you have Form 8962 and a 1095-A, and aren't sure what to do with them, go here for info on how to file them with your return. #WHY WOULD YOU RECEIVE A 1065 TAX FORM HOW TO# A Schedule K-1 (Form 1065) tax form reports on a partner’s share of the income, deductions, credits and more of their business. Insurance companies participating in health care exchanges should provide you with the 1095-A form, a health insurance marketplace statement. A partnership business structure has at least two partners. If you used them to pay for your health insurance and the amount you paid for coverage.Įach partner files a copy of this schedule with the Internal Revenue Service (IRS).#WHY WOULD YOU RECEIVE A 1065 TAX FORM UPDATE#.#WHY WOULD YOU RECEIVE A 1065 TAX FORM HOW TO#.

0 kommentar(er)

0 kommentar(er)